Making Ends Meet in Early Retirement: A Travelpreneur’s Guide

Living the dream of early retirement is fantastic, but many wonder how you manage financially. This question pops up from everyone, even old friends like my Aussie mate I ran into in Phuket! So, I decided to share my strategy for a comfortable, travel-filled early retirement.

The Secret Sauce: Income Streams and Strategic Investing

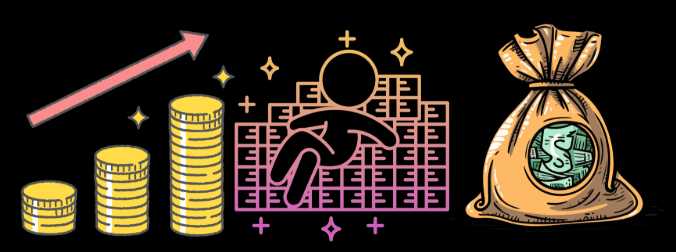

My approach relies on two key ingredients: generating regular income and strategically investing for future needs.

- Reliable Income Generator: Bonds form the bedrock of my plan, making up about 66% of my investments. They provide a steady stream of income, enough to cover a good lifestyle in India or abroad. This lets me travel for extended periods, like my recent adventures in Thailand and Sri Lanka, while still saving!

- Strategic Growth Engine: The remaining 34% goes into high-risk mutual funds. The Indian stock market is known for its growth potential, and mutual funds can potentially double your investment in 4-5 years. This acts as a future-proofing mechanism.

Living on Returns, Not Savings

Here’s the beauty of the plan: I’m not dipping into my savings! Instead, I strategically tap into the returns from my mutual funds. When inflation or other factors necessitate a higher income, I’ll methodically withdraw a portion of the mutual fund corpus and reinvest it into bonds. This way, my principal investment stays protected, and I continue living on the returns.

Win-Win and Travel-Travel

This strategy offers a win-win situation. My bond income lets me enjoy a comfortable life and travel as I please. The potential growth in the mutual funds ensures my income keeps pace with inflation and future needs.

Remember, this is my personal strategy. It’s important to consult a financial advisor to tailor a plan to your specific circumstances and risk tolerance. But hopefully, this gives you a glimpse into how early retirement with travel adventures can be a reality!

Hello, I am Aman (: Full Time Traveler :) At the age of 41, in April 2023, fueled by my love for travel and the determination not to remain fixed like a tree, I embarked on a bold journey. Having dedicated 17 years to a corporate job, I chose to transition from a full-time employee to a full-time traveler, driven by the desire to break free from the routine and constraints of a conventional life. Along the way, I not only explored the wonders of travel but also uncovered the transformative power of financial freedom. I realized how it could liberate me to lead a life teeming with adventure, purpose, and fulfillment. Through my blogs, I am passionately sharing my story, aiming to inspire and provide valuable guidance to those, like me, who aspire to weave travel into a life overflowing with limitless possibilities.

Post Comment

You must be logged in to post a comment.