The Untapped Power of Mutual Funds in India: My 7-Year Journey to Financial Freedom

Mutual funds have the potential to be a game-changer for Indian investors. While the stock market might seem glamorous, for most individuals, direct stock picking can be risky. This is where mutual funds come in, offering a powerful and accessible way to grow your wealth.

The Indian Mutual Fund Landscape: Facts and Figures

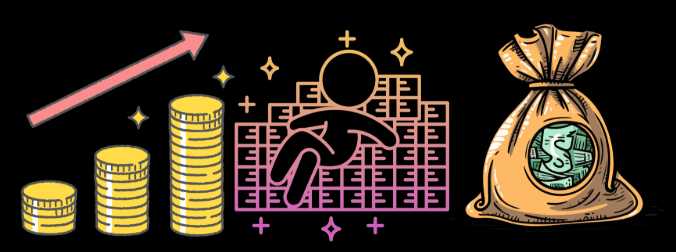

The Indian mutual fund industry is on a steady rise. However, there’s still a significant gap to bridge. As of December 2023, only around 4.5% of the Indian population directly invests in mutual funds [source: AMFI]. This presents a tremendous opportunity for growth.

Foreign institutional investors (FIIs) have played a crucial role in this growth. In 2023, the average monthly net inflow from FIIs stood at approximately ₹5,000 crore [source: AMFI]. This is complemented by domestic financial institutions and retail investors, who are increasingly recognizing the potential of mutual funds.

My 7-Year Journey with Mutual Funds

For the past seven years, I’ve been a proud mutual fund investor. It’s been a journey of learning, reaping rewards, and building a secure future. Through careful selection and a long-term approach, I’ve witnessed firsthand the power of these instruments. My experience has shown that with well-chosen funds, doubling your money within 4-5 years is a realistic possibility.

Why Mutual Funds? Here’s My Take

Here’s what makes mutual funds a compelling choice for investors like me:

- Professional Management: Unlike directly buying stocks, mutual funds are managed by experienced professionals who research, select, and manage a diversified portfolio. This reduces risk and leverages expertise for better returns.

- Variety for Every Investor: There’s a mutual fund for everyone. From low-risk debt funds to high-growth equity options, you can choose based on your risk tolerance and investment horizon.

- Power of Compounding: Starting early and investing regularly allows you to harness the magic of compounding. Even small contributions grow significantly over time, making mutual funds ideal for long-term wealth creation.

The Bottom Line: Invest Early, Invest Wisely

Mutual funds are a powerful tool for financial well-being. Don’t wait! Start investing a portion of your income early, and benefit from compounding over the long term. Remember, seek professional guidance to choose funds that align with your goals and risk appetite. By leveraging the expertise of fund managers and the variety of options available, you can unlock your financial potential and embark on your own journey to a secure future, just like I did.

Avoid the Get-Rich-Quick Trap: Patience is Key

The allure of high returns can be tempting, but it’s crucial to set realistic expectations for your mutual fund investments. Chasing unrealistic gains can lead some investors down risky paths, like venturing into overseas or thematic funds that may experience significant fluctuations. These forays can result in losses if not approached with caution and a deep understanding of the specific market.

The most successful strategy for most investors is a long-term perspective. By staying invested in established mutual funds that align with your risk tolerance and financial goals, you can weather market ups and downs and benefit from the power of compounding returns over time. Remember, patience is a virtue in the world of mutual funds.

Long-Term Strategy is Key

Building a successful mutual fund portfolio requires a patient and long-term approach. Don’t be lured by the promise of quick riches through overseas or thematic funds, which can be quite volatile. Focus on established mutual funds with a strong history of performance and consistently low expense ratios. Quant Mutual Fund AMC is a good example, offering several funds with a track record of success and competitive fees. It’s important to remember, though, that past performance doesn’t guarantee future results. Always conduct thorough research before investing in any fund. This should involve a deep dive into the fund’s investment objectives, holdings, risk profile, and past performance.

Additional Thoughts:

- Consider Systematic Investment Plans (SIPs) for a disciplined and hassle-free approach to investing.

- Diversification is key. Don’t put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk.

- Remember, there’s no guaranteed doubling of money in a short period. However, with a well-researched strategy and a long-term outlook, mutual funds can be a powerful tool for wealth creation.

References

There are a couple of articles discussing the potential upswing in the Indian stock market for the next decade or so. Dive-in and take the advantage because the growth story is here to stay:

- “India’s growth story here to stay for next 10 to 15 years: Aditya Shah” (Source) – This article features Aditya Shah, Founder of Hercules Advisors, who believes India’s economic growth will fuel a strong stock market for the next 10-15 years.

- “Indian stock market: No other country has a chance of doing what India can do in next 10-15 years: Jim O’Neill” (Source) – This piece highlights comments from Jim O’Neill, a former UK Treasury Minister, who sees India’s young workforce as a key driver for future economic and stock market growth.

Hello, I am Aman (: Full Time Traveler :) At the age of 41, in April 2023, fueled by my love for travel and the determination not to remain fixed like a tree, I embarked on a bold journey. Having dedicated 17 years to a corporate job, I chose to transition from a full-time employee to a full-time traveler, driven by the desire to break free from the routine and constraints of a conventional life. Along the way, I not only explored the wonders of travel but also uncovered the transformative power of financial freedom. I realized how it could liberate me to lead a life teeming with adventure, purpose, and fulfillment. Through my blogs, I am passionately sharing my story, aiming to inspire and provide valuable guidance to those, like me, who aspire to weave travel into a life overflowing with limitless possibilities.

Post Comment

You must be logged in to post a comment.